For many, many years part of the frustration with traditional Republican leaders from the grassroots of the party is that they didn’t get anything done. More and more it seemed to ordinary Republican voters that their Congressmen and Senators didn’t stand for the things they believed in, didn’t fight for the things they wanted, and offered a blank cheque to every Democrat or Progressive social disaster imaginable so long as the Republican half of the Uniparty got it’s junior partner share of perks and posts.

The classic image of the country club Republican was that they were lazy, unprincipled, elite windbags who even if they spoke a good game in election season delivered nothing whenever it mattered. And that the reason for this was simply that the failing system paid them well and made them feel important.

We have recently had a reminder of that feeling as, rather pathetically now, the powerless spectre of Bush Family Republicanism, George Dubya, is wheeled out to proclaim how much he is opposed to Trump’s 2nd term.

George Bush Jnr does so in now obvious alliance with Democrats, but it’s something anyone paying attention has known for a long time. A Bush declaring that he breaks with Trump on USAID cuts is so far as revelations of hidden interests go along the same lines as being told that AOC is stupid or that Liberace was gay. The Bush and Obama family friendship was never an amicable accord between politically opposed forces, but more like two mafia families in close alignment, who might snarl and snap for the entertainment of the footsoldiers, but were much more interested in peacefully sharing the profits of the heroin trade. The old Republican Elite couldn’t deliver any difference from a Democrat term, not simply because they were lazy, but because they were crooked, on the same payrolls diverting vast State spending into their private pockets. The social amity at charity events, or the respectful eulogies of Republicans and Democrats attending the same funerals and praising each others corpses, were indicative of a shared social class with shared corrupt interests.

Shared corruption over many years then was one of the primary causes of the apparent inability of Republican terms to ever deliver real change, to mend that which was broken, and to do something about both the social ills and breakdown of a fentanyl swamped, DEI hampered, Rustbelt ignored America and the elite leftist social radicalism on issues like transgenderism and the transitioning of children. Whether it was done with an Obama era Democrat tinsel wrapping of Hope and Change curled around a Marxist turd of racial politics and financial hypocrisies, or whether it was done with a Bush era tinsel wrapping of Patriotism and Security around a corporatist turd of Deep State surveillance and financial hypocrisies, the same neglect of true American interest was united to the same system of vast public spending.

The promise of Donald Trump was and is that he is different to that Uniparty style of Republicanism. That he Gets Things Done. That he delivers, and that what he delivers is some real reversal of things Republican voters want reversed. This is both an economic and a moral promise to make America great again, and the extent to which you love or hate Donald Trump still depends not just on whether you agree with the idea that America used to be better, but on whether you think he’s delivering the things he promised to deliver.

Public polling suggests that the vast majority of Republican voters think that he is delivering and are in agreement with the sentiment expressed above. It’s become a cliche now, but a tellingly accurate one, to note that Trump seems to know which issues are 80/20 ones and to side with the 80%. So far as Republican voters go, most very much think that the 2nd term is a success, despite the frustration of delays in delivery caused by running activist judicial opposition and sabotage. Trump’s approval ratings among Republican voters are exceptionally high, and when Trump clashes with other Republicans he generally receives the same degree of firm support he gets when clashing with Democrats.

The Big Beautiful Bill provides an example of this.

There was Republican opposition to the Bill. This seems to have been concentrated in the Koch funded Libertarian wing. The cause of this opposition was alleged to be that the Bill betrayed what Trump was elected to do. The Libertarian argument was a purist one in terms of spending and reducing debt. By this framing, the BBB was a failure and a betrayal because it included spending increases in certain areas, and didn’t include vast spending cuts in all areas. There wasn’t a huge reduction of State spending and therefore Trump delivered the same old profligate mess as any other Big Spender. Elon Musk, Rand Paul, Thomas Massie and others all made these points.

As with Elon Musk’s claims of frustration regarding the extent of DOGE savings actually enacted, or as with issues like Kennedy not banning mRNA vaccines or Patel and Bongino not delivering the Epstein Files, there is a non delivery, disappointed purit aspect to this opposition to the BBB.

But the purist spending argument, as with other examples, ignored key issues. It ignored 1.2 trillion dollars worth of spending cuts. It ignored the very important change to Medicaid which will see vast savings from preventing Medicaid spending on non citizens and illegal aliens. And it ignored thar where spending was increased, the kind of spending involved was radically different. The BBB was not funding insane projects such as we saw with USAID spending, or an associated network of NGOs and corrupt bribes and sinecures to an administrative and political elite class based in Washington. Spending increases in the BBB do not go on obvious ‘pork’ or on things the average Republican voter doesn’t want. They don’t go on largesse to other nations in versions of foreign aid, and they don’t go on funding trans opera in Guatemala.

It’s helpful at this point to reference an AI response to the query ‘what are the pros and cons of the Big Beautiful Spending Bill?, so long as we recall that AI only collates information and can do so in erroneous ways and according to bias in terms of the information it uses and the algorithms it functions by. Nevertheless once you realise that a few of the alleged ‘cons’ are very good things rather than bad things, it’s worth the risk of using it:

“The "One Big Beautiful Bill Act" represents a major overhaul of U.S. tax policy, extending and modifying provisions from the 2017 Tax Cuts and Jobs Act (TCJA) while introducing new tax and spending measures. On July 3, 2025, the Senate passed its version of the bill, which the House subsequently approved, with President Trump expected to sign it into law on July 4, 2025.

Pros of the Bill:

Economic Growth and Investment: The bill promotes long-term economic growth by making permanent the expensing provisions for investment in short-lived assets and domestic research and development. This provides certainty for businesses to invest, boosting GDP by an estimated 0.7 percent in the long run.

Tax Certainty for Households: It permanently extends the TCJA’s individual tax cuts, including the increased standard deduction and modified alternative minimum tax thresholds. This simplifies the tax code and provides stability for households.

Improved SALT Cap Treatment: The Senate bill raises the state and local tax (SALT) deduction cap to $40,000 (adjusted annually) for taxpayers earning under $500,000 through 2029, offering temporary relief compared to the House version which makes the higher cap permanent.

Support for Small Businesses: Both versions of the bill retain and enhance Section 179 expensing, allowing small businesses to deduct a higher threshold of equipment investments, encouraging business growth.

Cons of the Bill:

Massive Deficit Impact: The Senate version reduces revenue by $5.0 trillion on a conventional basis and $4.0 trillion on a dynamic basis over the next decade. This significantly increases the national debt, potentially pushing publicly held debt to 130 percent of GDP, the highest in U.S. history.

Gutting of Clean Energy Incentives: The bill rolls back many of the clean energy tax credits introduced by the 2022 Inflation Reduction Act (IRA), threatening the ongoing clean energy investment boom and potentially increasing energy costs by hundreds of dollars annually for households.

Medicaid and SNAP Cuts: The Congressional Budget Office (CBO) projects that Medicaid cuts in the bill will result in over 10 million Americans losing health coverage. Additionally, the Senate bill’s changes to the Supplemental Nutrition Assistance Program (SNAP) may affect more than 40 million people, including millions of children, seniors, and disabled individuals.

Favoring Wealthier Taxpayers: The bill disproportionately benefits the wealthiest Americans, with the richest fifth of households receiving an average benefit of 2.3 percent of their income, or $6,055, while offering limited relief to low-income families who may not qualify for the full child tax credit.

Student Loan Burden Increase: The bill effectively ends the Biden administration’s student debt repayment program, increasing annual payments for many borrowers. A typical borrower with a college degree and an income of $80,300 would pay an additional $2,929 per year.

The bill also includes controversial provisions such as a deduction for tips and overtime pay, which critics argue are politically motivated and violate principles of tax fairness. Additionally, the legislation weakens consumer protections by cutting funding for the Consumer Financial Protection Bureau (CFPB) by about half.

In summary, while the One Big Beautiful Bill offers some pro-growth tax policies and stability for households and businesses, its long-term fiscal impact, cuts to social programs, and uneven distribution of benefits raise significant concerns about its overall economic and social consequences.”

Now even with the bias that is fed into or programmed into this AI, a few things become very clear that destroy both the purist Libertarian argument against the BBB, AND the Democrat objections to it as well.

It’s true that the BBB doesn’t solve, in one fell swoop, the problem of vast State spending. And it doesn’t do an enormous amount of good in terms of reducing government spending and solving the fact that the federal government spends a lot more than it brings in and is dependent on an ever increasing mountain of debt. In the short term even it might appear to make these problems worse, because on paper the tax cutting and business support measures within it will both immediately reduce revenue coming in and immediately increase spending going out.

Tax cuts always look, at first glance, like a loss of revenue and a problem for the State impacting its ability to deliver anything else. They can be reported as if they are some kind of loss (“reduces revenue by $5.0 trillion on a conventional basis”). But to read tax cuts this way is to ignore the stimulus impact of low taxation and the stagnation effect of high taxation. For anyone familiar with the Laffer Curve any and all descriptions of a tax cutting Bill as being harmful to State revenue or economically damaging overall is an economically illiterate point made by the kind of people who think that it is possible to tax a nation into prosperity and success. Tax cuts are the single best means of pushing beneficial economic growth driven by private spending and consumer confidence and in most cases will see a surge in State revenue from economic stimulus that more then compensates for the reduced base rate of taxation being taken from individual citizens.

The BBB is full of tax cuts. Because of that, it is sure to stimulate economic growth and work better for the economy than what went before it. And that does mean an improvement of life for millions of Americans. Whether you are a deficit and debt focused libertarian who wants to see a slashing of government spending as the only route to economic success, or a leftist or a full on Marxist who wants to see private wealth punished and the State taxing heavily to fund vast redistributions of wealth, you are in both cases ignoring the way economies actually work.

Large State spending is more sane and endurable if that spending is transferred from economically illiterate and socially malign things, towards economically beneficial and socially positive things. The BBB fails as a slash and burn libertarian fiscal purity project. But it succeeds as a populist and rational economic stimulus package which transfers the concept of stimulus from Keynesian grand projects or corrupt globalist networks to the proven advantages of tax cuts and incentives on entrepreneurship. What both tax cuts and support for things like companies building new factories in the US provides is the kind of stimulus that ultimately pays for itself, many times over. It’s a shot in-the arm for America’s economic growth, and a fulfilment of the Blue Collar promises of Trumpism. If you prompt your economy towards better wealth generation, and if you are doing that by taking a lower government cut and by focusing spending on things that are genuinely productive, the Laffer Curve ensures that you can actually meet a high State spending burden WITHOUT increasing debt. The general economic upturn you’ve created shoulders the burden for you.

It’s probably true that State spending and debt is still too far too high. But what’s being achieved with the BBB is a transfer of spending from stagnating waste to stimulating growth AND from non-American interests to American ones. There are tax breaks for Main Street and small businesses. There’s the removal of Green subsidies and taxes which both reduce a burden and stimulate traditional energy provision which has a huge knock on positive effect for your economy. This will mean cheaper energy, saving the family heating their home AND the running costs for a company with energy supply requirements to keep a factory going. No longer spending on medical provision for millions of people who shouldn’t be entitled to it will be another factor reducing illegal entry in the first place and a populist MAGA prioritisation of the existing citizen which deliver immediate benefits to actual Americans (and not merely economic ones either). Stopping the Biden era insanity of a blank cheque underwriting millions of worthless university degrees and feckless university educated but economically useless graduates being propped up by the State while they dream of Marxist Revolution can only be helpful too.

The BBB is literally taking Green Scam money and Gender Studies Degree madness and putting the money back in the pockets of ordinary people instead, or in very sensible things like incentives to building factories in America or in adding 10,000 ICE agents. Under Biden the idea was to add 10,000 IRS agents to screw the average American more while money was pumped into foreign causes and set aside for foreign invaders. Under the BBB 10,000 more ICE agents will protect the American people from invaders, cartels and foreign rapists and murderers while students who support Marxism are forced to pay their own debts and the average American family gets a tax cut that could benefit them by up to $10,000 a year.

Yes, this is still a federal government spending eye-watering amounts of money, and yes that spending has to be got under control soon. But what a difference in the kind of spending going on. That transition, from waste to real stimulus, is the one that provides the platform for debt reduction in the future, for a debt reduction that won’t tip into chaos and lack of confidence. The BBB cuts off some of the worst waste (Green Scam bills, student loan debt cancellation, underwriting the medical bills of non citizens) while focusing very much on that Blue Collar promise of economic growth, incentives to work, and rebuilding a strong industrial and manufacturing base at home.

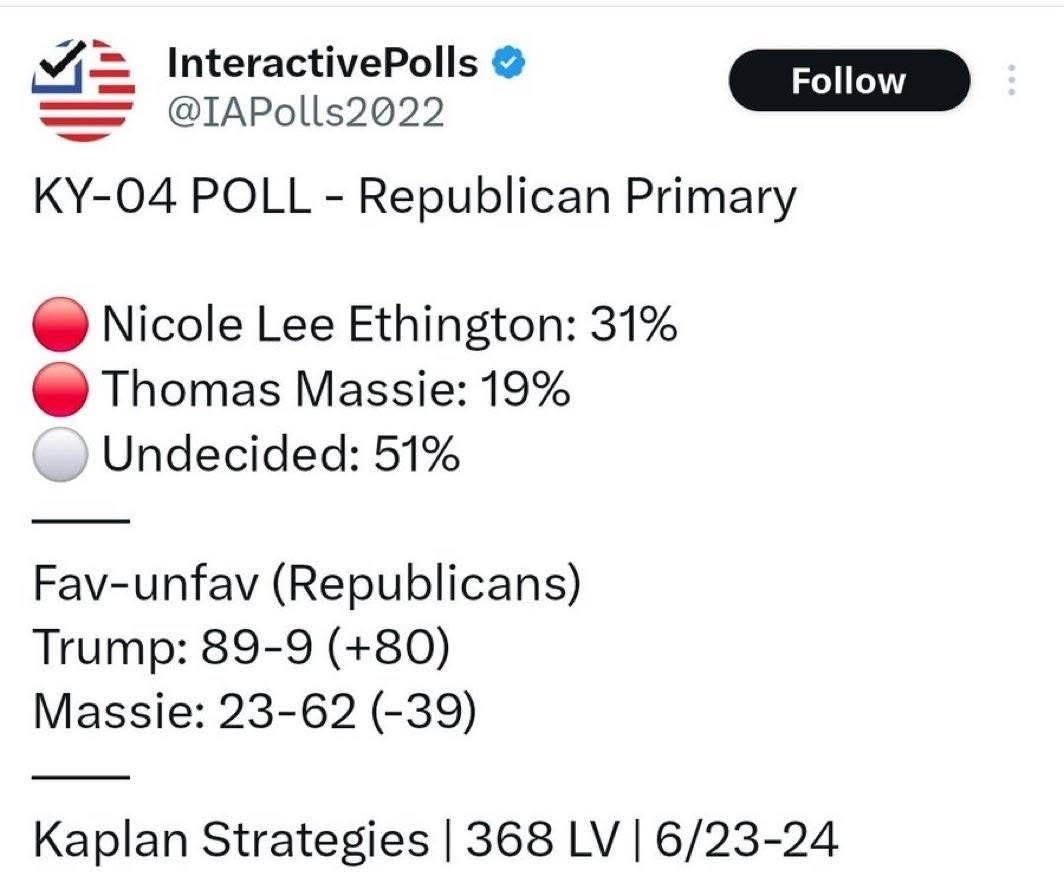

And when it came down to it? The Republican opposition was literally just one or two people. Massie stood alone, and most Republican voters looking at the BBB realised that it was the transfer of spending from wasteful causes to desired ones, together with a direction of travel on spending restraint rather than an instant libertarian axe to everything, that mattered most. The voter reaction is very, very clear, no matter how loud some purist voices of dissent are:

Republican voters trust Trump to deliver the real positive, populist changes they want, not Thomas Massie style economic libertarian purists. Just as with the alliance and then divorce with Elon Musk and the earlier battles with Bush style Country Club Republicans, it’s generally the case that when Trump clashes with other Republicans he is ultimately the one trusted to deliver real results. We have seen this time again. The MAGA influencers claiming to be more America First than Trump on Iran were immediately made to look foolish and irrelevant, but are another example of the same process. The highly disillusioned Trump voter does exist, but is far outnumbered by the satisfied and even delighted Trump voter who prioritises, like Trump, results over abstract theory.

The BBB did not need to end State spending or suddenly reduce State spending by 80%. It needed to move State spending from insane things to sane things first. Getting debt under control was never going to be solved instantly, but is definitely going to be easier to solve in a booming economy where Democrat and Uniparty funding streams are being replaced by sensible growth incentives. What the Massie purist argument ignores is also that the BBB by enforcing the border and funding the removal of illegals will make a massive difference as to whether or not future Republican administrations can tackle the debt and other areas of waste by being in government in the first place. Tax cuts, blue collar incentives, job production, wealth creation, growth focused AND striking at some core areas of Democrat corruption too?

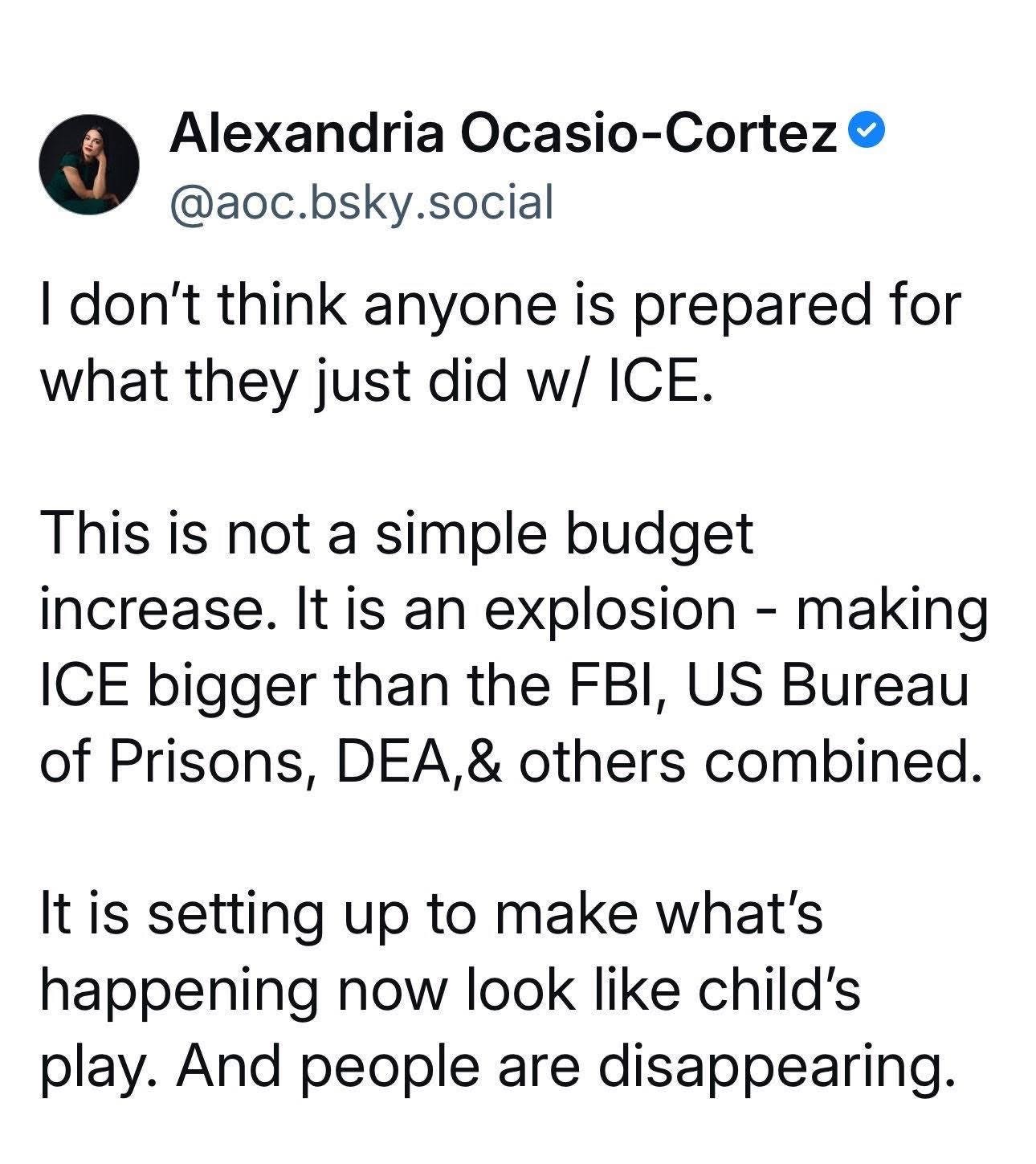

There’s a lot of delivery there even without significant debt reduction coming yet. Johnson may be calling this far too confidently and far too soon, but the fact is that the ICE measures and border measures in the BBB ALONE, let alone the tax reduction and business growth measures in there too, represent real delivery of Trumpist populist measures. And the enemy knows it:

Ironically, Trump’s Always Enemies recognise that more readily than some of his more recent libertarian allies do, unless we believe that Koch funded libertarian types have always been an enemy within in the same way that Bush country clubbers and CIA stooges are. As it happens I liked Musk when he was being sensible, I liked Rand Paul and I like and agree with controlling and reducing spending and preferring a small State to a large, corrupt and out of control one. Libertarian purists are t wrong on the benefits of small government….but they are wrong to fight against Trump shifting spending from worthless things to sensible things.

Ultimately, if I’m given the choice between total purity on spending which doesn’t actually stop high spending but simply allows Biden era spending to carry on, and passing a Bill that reduces taxes, promotes growth, ends the Green Scam, and undercuts the anti American scheme of importing millions to create permanent Democrat tyranny….which is the sensible America First stance? Which one represents some actual delivery, given that full perfection is very hard to reach in real life?

It’s not the spending purity one that is delivering anything on this issue. It’s the control borders and stimulate growth one that does. I still love listening to Rand Paul talk about insane government spending and I still retain respect for Elon Musk championing free speech. I’ve not turned totally against these figures for their libertarian purity based attacks on Trump, nor do I necessarily see them as corrupt in these attacks the same way that other enemies of Trump are corrupt. I don’t think it’s all about Koch funding or all about Elon’s EV subsidies.

Libertarians are theoretical purists. Some are fanatical on a single point and more in love with an abstract principle than with real world effects, when an administration must act on several fronts at once and when populism, by contrast, notices real world effects first. It seems very odd to me that someone like Massie doesn’t factor in the economic costs and connection with State debt, corruption and waste coming from open borders when pursuing a purist spending crusade, but that could be the sincere error of an ideological fanatic as much or more than it is another example of corruption.

Either way, like Trump voters and supporters generally, I trust him to deliver more then I trust anyone else to, and see the BBB not as a contradiction of that trust, but a confirmation of it. Bring me further spending cuts when the time is right, but bringing me growth and secure borders and tax cuts today is a pretty good start, especially given that the bit of the Bill I was really most worried about (a federal ban on State restrictions on AI) was removed from it before it passed.

Excellent and realistic analysis of the BBB. I still have trouble reconciling Elon’s opposition to it as a libertarian; the others I can accept since they have been like that. I continue to value Elon’s immense contributions to our world. It bothers me that he practiced what it is the most important aspect of the BBB - increasing debt for the right causes to stimulate growth. His companies would not survive without it.

Fantastic overview! There have been so many views and opposing views from my conservative friends and family on BBB during which I had an intuitive feeling that they were all focused on the wrong things. You have masterfully put into words what I couldn't. We must immediately fix the crises we've inherited from Biden that are right in front of us, and then later deal with the outlandish debt. Thank you!